Supplemental Information

Is It All About PERS?

Yes, and no.

Oregon faces both revenue instability and inadequacy.

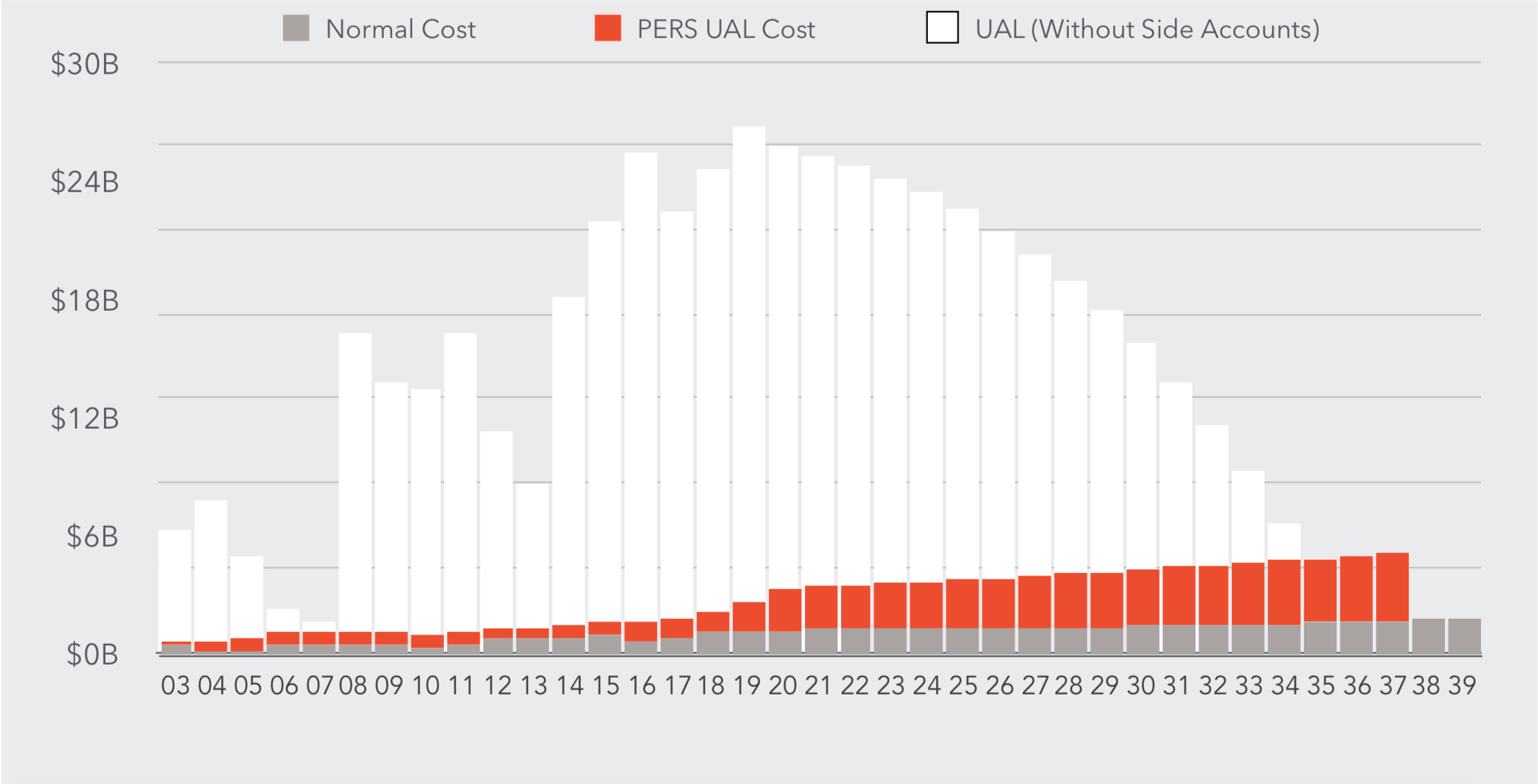

But the state’s strategy to eliminate the PERS unfunded liability is the cost driver behind ongoing budget imbalances for public agencies — from schools to fire and water districts to parks and public safety departments — over the next 20 years.

Oregon’s pension system is what many people think of when they talk about the state’s looming fiscal crisis. In the April 2018 article, “A $76,000 Monthly Pension: Why States and Cities are Short on Cash,” The New York Times crystallized much current thinking about the relationship between the struggling local governments and Oregon’s partially funded pension reserve.

What the New York Times got right was focusing on a growing crisis affecting local government budgets in Oregon and around the nation. However, they oversimplified the cause of the challenges we face — and in so doing, obscured where we might find solutions.

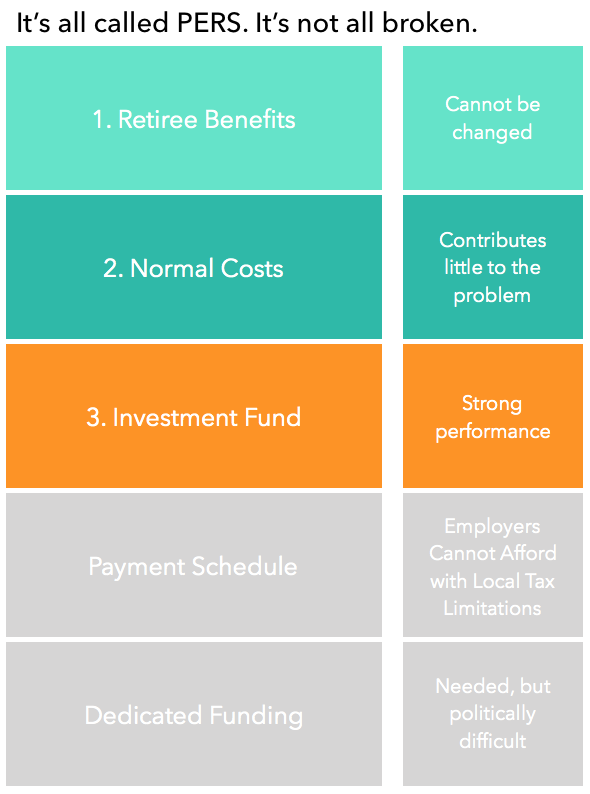

PERS is really three things. These three components impact the monthly costs of the PERS system in different ways. Imprecise treatment of these elements results in frustration or misunderstanding for those looking for timely solutions at the scale of the problem.

PERS is the check that retirees receive now, fulfilling the promise made to them by employers and the state in the past. This promise is constitutionally protected.

PERS is the benefit offered to current workers today as part of their total pay package.

PERS is the investment fund that manages contributions from employers and employees to save for retirement. The performance of PERS investment accounts determines how much public employers need to contribute within a timeline that is set by state policy. The Payment schedule determines how quickly the investment portfolio is funded.

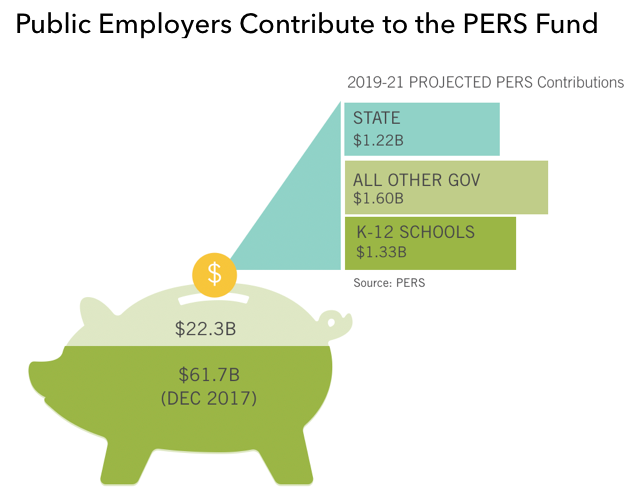

As of December 2017, the total pension commitment for Oregon was $84B, and $61.7B had been accrued through a combination of employer contributions and investment returns. This left an Unfunded Accrued Liability (UAL) of approximately $22.3B (current estimates of the UAL hover around $26.6B).

When most people think about reforming PERS, they think about changing the retirement benefits that Oregon offers to workers today. But the vast majority of the UAL represents a “legacy obligation” promised to people who have already retired, and linked to two benefit plans that are no longer offered to new hires. Six percent of the UAL is associated with the third tier OPSRP plan for current employees.

Potential solutions at the scale of the problem include new dedicated revenue, changes to the payment schedule designed by the state, and innovations in public program delivery.